How could you utilize small loans Alabama the money you would be saving into the monthly payments?

When you are settling the home loan very early to provides a great deal more monthly cash flow, you’ll have a concept of how you plan to use one more money. If you want to cut right out your own $900 homeloan payment and you can dedicate $900 monthly in its lay, that will be a good use of the currency.

Fundamentally, it’s up to you simple tips to spend extra money. But if you can’t contemplate what you should carry out to the currency, or if you’ll spend it to the frivolous instructions, paying down your mortgage very early may possibly not be the best monetary circulate.

Why does settling the home loan early fit into pension package?

Once you know we would like to stay-in this domestic while in the advancing years, investing it well today so that you won’t need to make month-to-month money when you look at the advancing years might be the right flow.

However if you are, say, a decade out-of retirement and you will have not been using yet, purchasing would-be a better use of the currency than just spending off of the financial early.

Do you have most other expense to settle?

![]()

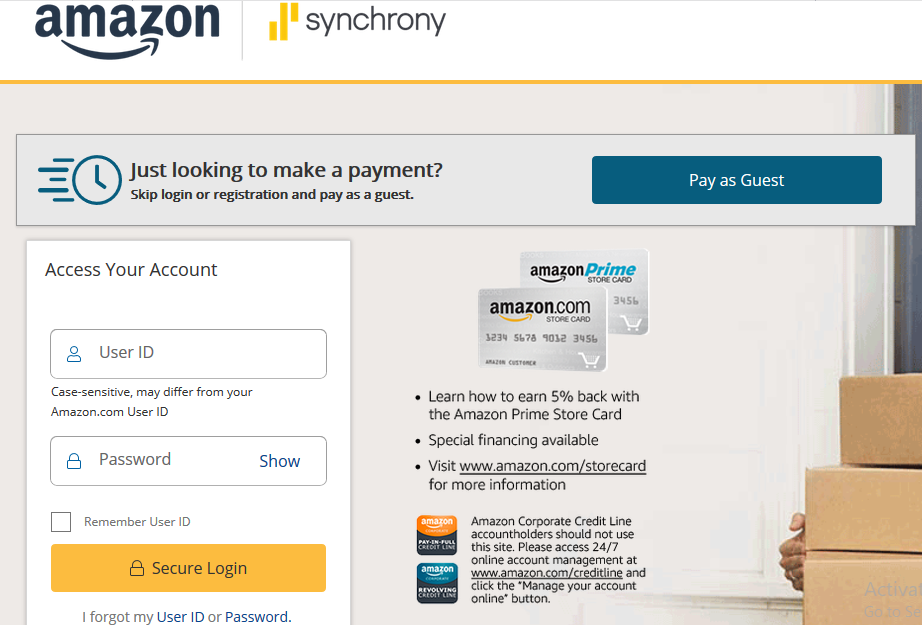

The overall principle is that you is to run repaying highest-interest financial obligation ahead of all the way down-attention debt. You are paying a high rate on the a credit card otherwise personal education loan than on your own home loan, therefore you might benefit even more by paying those individuals off very early.

Never pay plenty on your higher-focus obligations you exposure defaulting into the home loan repayments, even in the event. Sure, playing cards should be expensive, while the issuer can take legal action if you standard to the card payments. But defaulting on home loan repayments should be a great deal larger exposure, because you you’ll get rid of your residence.

What other possibilities have you got?

If you are looking so you’re able to sooner provide specific place in your month-to-month budget otherwise spend less on attract, and make extra money on your own home loan isn’t really your only choice.

Refinancing makes it possible to decrease your monthly premiums, both of the reducing your speed or by stretching your loan name so that you do have more time and energy to pay your debts.

In the event the paying off your loan very early ‘s the purpose, refinancing to your a shorter term will assist you to achieve that whenever you are saving cash towards interest.

When you yourself have a large amount of money we need to put to the their home loan, you might think a lump sum payment or home loan recast.

Which have a lump sum, you make you to high commission for the the principal so your home loan is repaid early. However with good recast, you only pay one to same lump sum and ask your own financial assess exactly what your monthly payment might be considering the new, lower principal count. Then you will have a similar title length however, less month-to-month fee going forward.

There’s no obvious correct or wrong address throughout the even though you ought to pay off the financial early. This will depend on your state as well as your individual needs.

Financial calculator

Explore our very own totally free financial calculator to see exactly how settling your home loan very early make a difference your finances. Connect on your own numbers, following just click “Additional info” to possess details about paying additional every month. You can even have fun with an algorithm to figure out your own month-to-month principal payment, in the event using a home loan calculator is much easier.

- Damage your credit rating.Numerous factors make up your credit rating, and another is your combination of borrowing from the bank items. Like, maybe you’ve a charge card, auto loan, and you may financial. By firmly taking out one kind of borrowing from the bank, your credit score usually drop-off. This ought to be a fairly brief get rid of, however it is something you should thought.

Leave a Reply